maryland ev tax credit 2021 update

In January the Clean Cars Act of 2020 was introduced to extend the program for another three years. Beginning on January 1 2021.

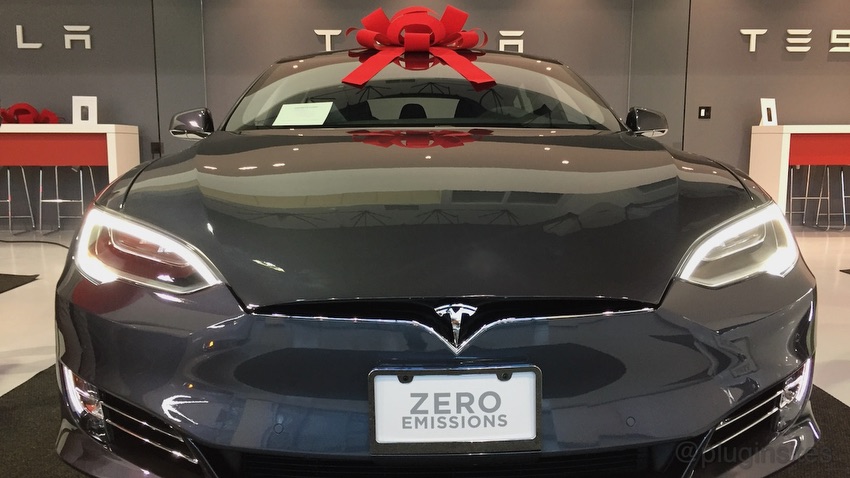

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Annual funding would increase to as much as 26000000 through fiscal year 2023 under the proposal by Delegate David Fraser-Hidalgo.

. Vice President Kamala Harris charges an electric vehicle in one of the charging stations during her tour of the Brandywine Maintenance Facility in. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. 2022 Homeowners Tax Credit Applications will become available on February 23 2022.

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites Sunday February 13 2022 Edit. Increasing from 1200000 to 1800000 the amount of rebates that the Maryland Energy Administration may issue. Maryland ev tax credit 2021 update.

The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Buy friday hours wallpaper. As a new resident of Maryland you must title your vehicle within 60 days of moving to Maryland.

The EVSE Rebate Program aims to reduce the financial burden of acquiring andor installing charging stations and to increase EV. Requiring the Motor Vehicle Administration and the Maryland Department of the. The 2021 Homeowners Tax Credit Application deadline was October 1 2021.

Our firm has been working in the historic tax. Maryland citizens and businesses that purchase or lease these vehicles. Increasing from 1200000 to 1800000 the amount of rebates that the Maryland Energy Administration may issue.

We will continue to follow its progress and update this page with the latest as it hopefully moves forward. Electric Vehicle Supply Equipment EVSE Rebate Program. Best Buy is one of the nations top electronics retailers with a large selection of computers tablets c.

The rebate is up to 700 for. Between July 1 2021 and June 30 2022 the rebate may cover 40 of the costs of acquiring and installing. The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market.

It also proposed to increase the annual funding from 6000000 to 12000000. Sign up to receive important email updates about these tax credits. You may be eligible for a one-time excise tax credit up to 300000 when you purchase a qualifying plug-in electric or fuel cell electric vehicle.

As it stands the credit provides up to 7500 in a tax credit when you claim an EV purchase on taxes filed for the year you acquired the vehicle. Requiring the Motor Vehicle Administration and the Maryland Department of the. The credit ranges from 2500 to 7500.

Effective July 1 2017 through June 30 2020 an individual may be entitled to receive an excise tax credit on a qualifying plug-in electric or fuel cell electric vehicle regardless of whether they own or lease the vehicle. Funding is currently depleted for this Fiscal Year. Income tax tables and other tax information is sourced from the maryland comptroller of maryland.

In 2021 over 1000 new EVs were registrations on average each month a 41 increase compared to 2020. Does your electric vehicle qualify for. The Electric Vehicle Supply Equipment EVSE Rebate Program provides funding assistance for costs incurred acquiring andor installing qualified EV supply equipment also referred to as charging stations.

Tax deferral program for elderly or disabled homeowners. Proof of military status ie. Vehicle Registration Tax Credit.

State Tax Credit for Vehicles and Vessels Benefits. Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in Hybrid. The Clean Cars Act of 2021 HB 44 proposes to extend and increase the funding for the Maryland electric vehicle excise tax credit.

Military ID or equivalent must be submitted to be eligible for an excise tax credit. Maryland Excise Tax Credit Not Reauthorized for FY 2021. If the owner is a member of the military on.

Federal Income Tax Credit A federal tax credit is available to buyers of new plug-in electric vehicles based on battery capacity and ranges. Ev tax credits cannot be passed on. Public Comments Lanny Hartman requested more consistency and transparency from the Maryland government regarding EVs and electric vehicle infrastructure initiatives.

Extending and altering for fiscal years 2021 through 2023 the Electric Vehicle Recharging Equipment Rebate Program for the purchase of certain electric vehicles. Maryland state legislation could increase the tax credit received for electric cars to 3000 per vehicle. On Black Friday then 9 am.

Best buy hours black friday. Maryland offers a rebate of 40 of the cost of Electric Vehicle Charging Equipment and Installation. As of December 31 2021 there were 41474 registered electric vehicles EVs in Maryland.

House Bill 1279Senate Bill 778 Acts of 2021 - This bill changes the existing Regional Institution Strategic Enterprise RISE Zone Program by establishing a rental assistance program establishing a Regional Institution Strategic Enterprise Fund enhancing biotechnology investment incentive and cybersecurity investment incentive tax credits limiting the zone size and limiting. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla. Extending and altering for fiscal years 2021 through 2023 the Electric Vehicle Recharging Equipment Rebate Program for the purchase of certain electric vehicles.

Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. The Maryland Energy Administration MEA offers a rebate to individuals businesses or state or local government entities for the costs of acquiring and installing qualified EVSE. Unfortunately the bill didnt pass before the Maryland General Assembly adjourned early due to COVID-19.

For model year 2021 the credit for some vehicles are as follows.

Rebates And Tax Credits For Electric Vehicle Charging Stations

.jpg)

Latest On Tesla Ev Tax Credit February 2022

How Many Evs Are Registered In Your State You May Be Surprised

The Surge Of Electric Vehicles In United States Cities International Council On Clean Transportation

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech