personal property tax richmond va due date

The tax is billed around November 1 with a due date of December 5. Tax rates differ depending on where you live.

Guide To African American Manuscripts Virginia Historical Society

Real Estate Tax Frequently Asked Questions FAQs What is the due date of real estate taxes in the City of Richmond.

. Real Estate and Personal Property Taxes Online Payment. Tax Dates and Deadlines Date Deadline. Property Taxes are due once a year in Richmond on the first business day of July.

Interest is assessed as of January 1 st at a rate of 10 per year. Team Papergov 1 year ago. On this page you will find tax assistance programs for the City of Richmonds Department of Finance.

Personal property taxes are billed annually with a due date of december 5 th. Pay Your Parking Violation. Personal property tax due.

Federal Income Tax Returns Due. Parking Violations Online Payment. A recognized pricing guide must be used for the assessed value.

Deadline to file real estate assessment appeal with the Department of Tax Administration. If you are contemplating moving there or just planning to invest in the citys property youll come to know whether the citys property tax rules work for you or youd. The minimum assessment is 12500.

Real Estate Tax Payment Due First Half. What is the real estate tax rate for 2021. Real estate tax rate set by Board of Supervisors.

It is due for the full year. If the due date falls on a weekend or legal holiday payments are due on the first business day following the due date. As of December 31 st of the year preceding the tax year for which assistance is requested the taxpayer must be a Richmond County resident and said property must be occupied as the sole dwelling for the taxpayer.

Installment bills are available online and taxpayers can sign up for paperless real estate and personal property tax bills. City Code - Sec. Personal Property Taxes Personal Property taxes are billed annually with a due date of December 5 th.

The personal property tax is calculated by multiplying the assessed value by the tax rate. Second installment real estate tax payment due. Installment bills are due on or before June 5th and on or before December 5th.

The assessment of personal property is made by the Commissioner of Revenue as of January 1 of each tax year. Business Personal Property Machinery Tools Tax Return Filing Deadline. Value of Real Estate Personal Property and Machinery Tools Established.

Any unpaid taxes after this date will receive a second penalty. Real Estate and Personal Property taxes are mailed in April and November. The personal property tax is not prorated for persons moving out of Harrisonburg or for the disposal of a vehicle after January 1.

If a vehicle is not listed in the pricing guide the assessed value is calculated by depreciated cost. First installment real estate tax payment due. Deadline to file real estate appeal with Board of Equalization.

The second due date for an outstanding tax balance is September 2 2022. Each section is complete with information and necessary forms to apply for assistance or adjustment. In city of richmond the reassessment process takes place every two.

To contact customer service regarding questions about your false alarm bill call toll-free 1-877-893-5267. Personal Property Taxes. 49 for 2020 x 69480 34045.

Personal property tax car richmond va. If you have questions about personal property tax or real estate tax contact your local tax office. Personal Property taxes are billed annually with a due date of December 5 th.

Business License Renewals and First Installment Payment Due. The 10 late payment penalty is applied December 6 th. Real estate taxes are due on January 14th and June 14th each year.

5 and would provide a reduction of 6240 for the owner of. Harrisonburg VA 22801-3610. Tax rates differ depending on where you live.

Use the map below to find your city or countys website to look up rates due dates. June 5 and December 5. If the due date falls on a weekend or legal holiday payments are due on the first business day following.

Additionally supplemental bills may be sent out from time to time due to. What is considered real property. 1st half real estate tax due.

Business Tangible Personal Property Tax Return2021 2pdf. Studying this recap youll get a good understanding of real property taxes in Richmond and what you should be aware of when your propertys appraised value is set. Individual credits would be applied to the second installment of personal property bills due Dec.

Delinquent real estate and personal property bills mailed. The real estate tax rate is 120 per 100 of the properties assessed value. Installment bills are due on or before June 5th and on or before December 5th.

Personal Property Taxes Due. Richmond residents will have until July 4 to pay their property taxes without penalty. Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill.

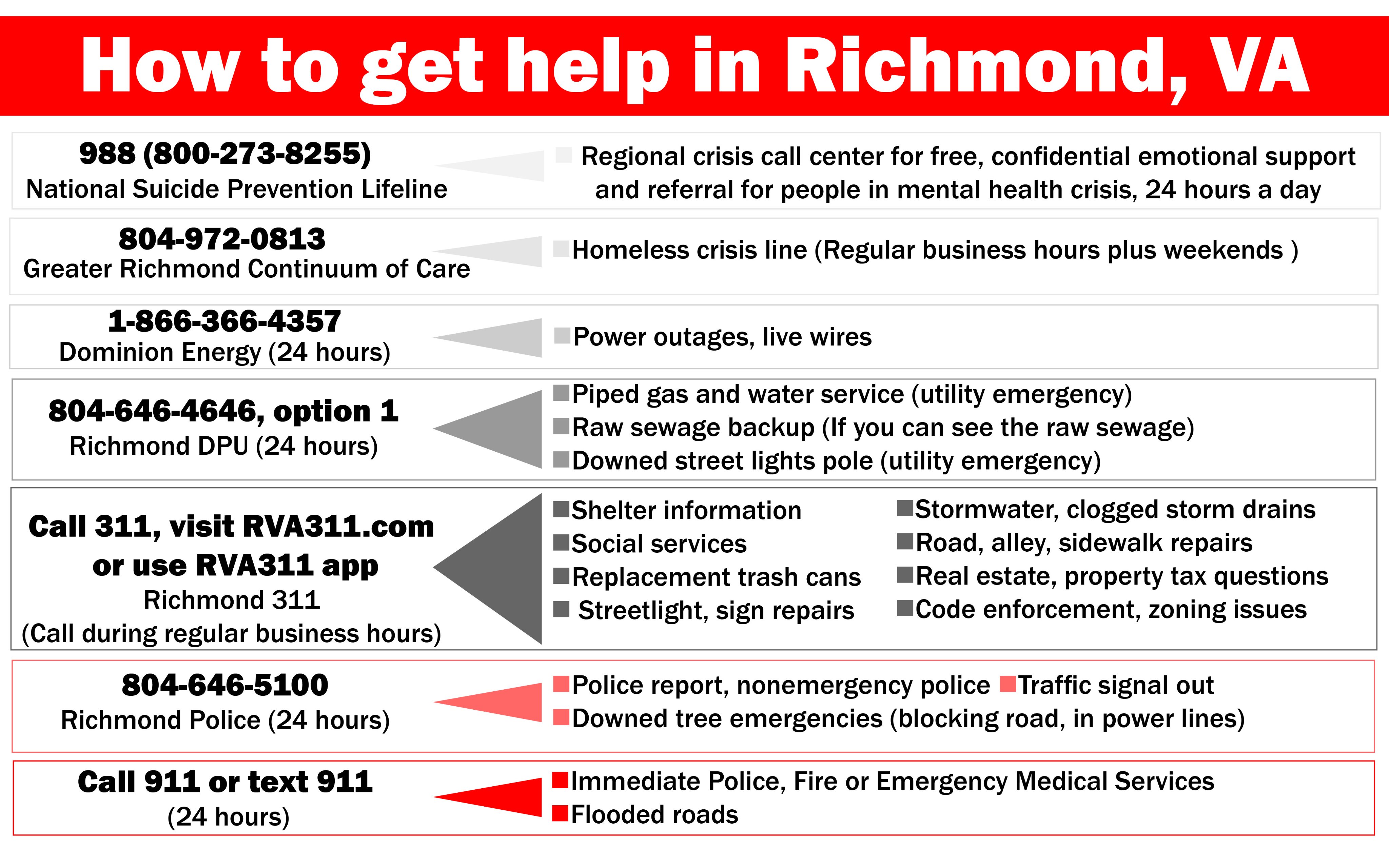

Call 804 646-7000 or send an email to the Department of Finance. Other Useful Sources of Information Regarding False Alarm Fees. Business Tangible Personal Property Tax Return Richmond.

Below are categories of assistance which can potentially limit tax payments for real estate and personal property for those who qualify. Click Here to Pay Parking Ticket Online. Questions answered every 9 seconds.

Parking tickets can now be paid online. 1st half real estate tax bills mailed. To visit the site register your alarm or make a payment visit Cry Wolf.

540-772-2006 Staff Directory. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. The regular billing cycle for Personal Property taxes has 2 due dates during the year.

The taxpayer may be temporarily in the hospital nursing home etc and still qualify for relief. Mon day July 4 2022. Property Taxes are due once a year in Richmond on the first business day of July.

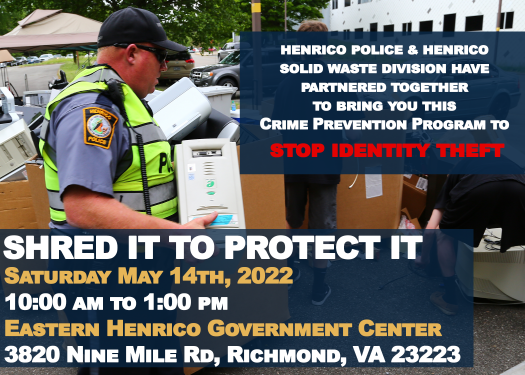

Shred It To Protect It Henrico County Virginia

Mayor Levar M Stoney Levarstoney Twitter

Henrico County Coronavirus Tax Relief Virginia Cpa Firm

4430 Sharonridge Dr Richmond Va 23236 Realtor Com

Pay Online Chesterfield County Va

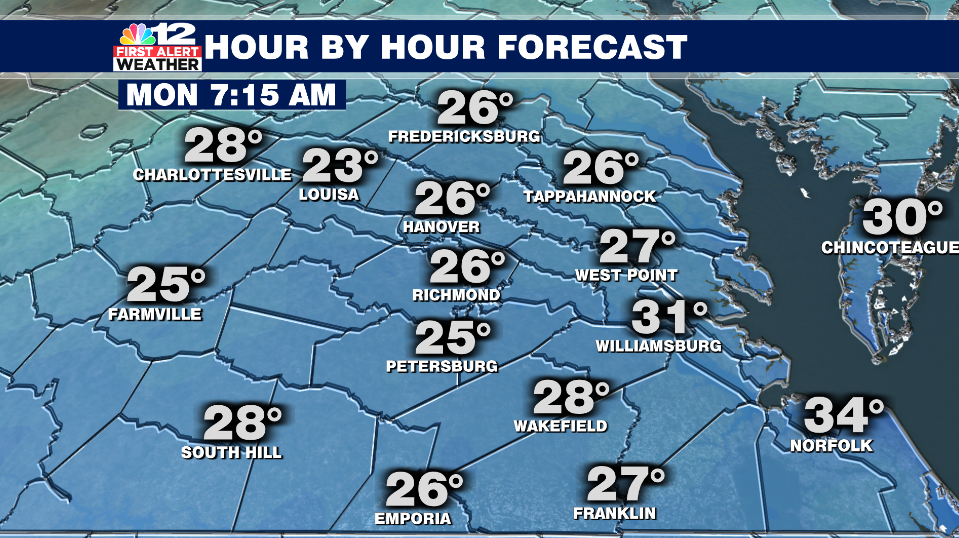

First Alert Hard Freeze Expected Again Tonight

Henrico County Coronavirus Tax Relief Virginia Cpa Firm

/cloudfront-us-east-1.images.arcpublishing.com/gray/XTQ6YFH2XFAERNEHQGOAVPPX6U.png)

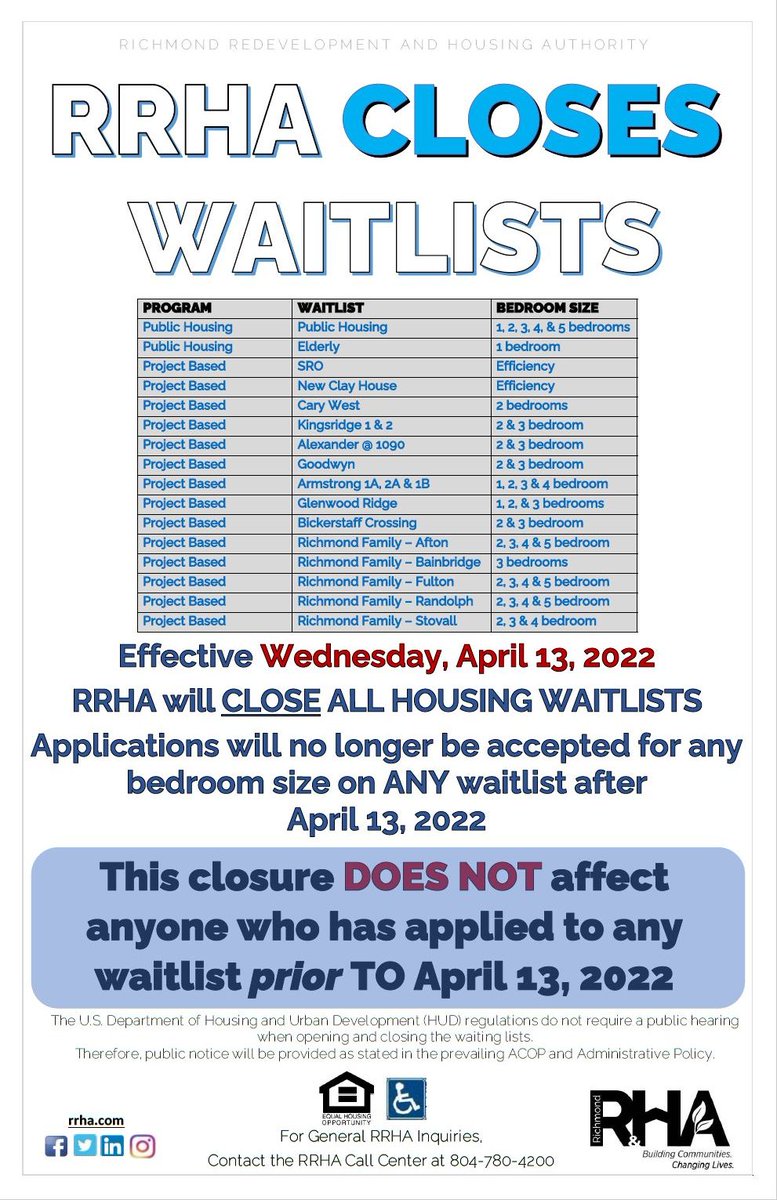

Rrha Closing All Housing Waitlists

Rrha Closing All Housing Waitlists

Chesterfield County S Guidelines For Paying Personal Property Taxes Due On June 6 Wric Abc 8news

Women Infants Children Wic Henrico County Virginia

/cloudfront-us-east-1.images.arcpublishing.com/gray/A6WHHH4ZUVE5BPHCIYUKMJ5GWE.jpg)

Don T Forget About The Gift Cards You Got Over The Holidays

Virginia S Individual Income Tax Filing Extension Deadline For 2020 Taxes Is Nov 17 2021 Virginia Tax

/do0bihdskp9dy.cloudfront.net/05-06-2022/t_b869912cf8734eef85756fb1374d4d11_name_file_1280x720_2000_v3_1_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/HVRHN7Y7UNCPVEESASITOTQZ2Y.PNG)