what is a fit deduction on paycheck

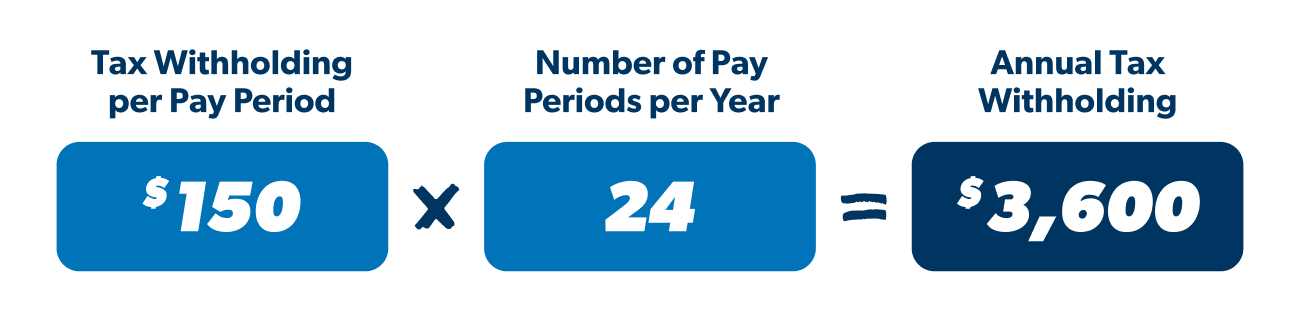

Web Tax Withholding. Web Withhold half of the total 153 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

Pay Stubs A Detailed Guide Upwork

FICA taxes consist of Social Security and Medicare taxes.

. The rate is not the same for every taxpayer. The other half of FICA taxes is owed by. Web Answer 1 of 3.

With this information you can prepare for tax. Web FICA taxes are commonly called the payroll tax. First fit deduction is an IRS Tax Code feature that allows you to deduct the.

The federal income tax rates. Federal Income Tax is withheld from your paycheck based on the amount of income you earn in each pay period. Web FIT represents the deduction from your gross salary to pay federal withholding also known as income taxesFIT deductions are typically one of the largest.

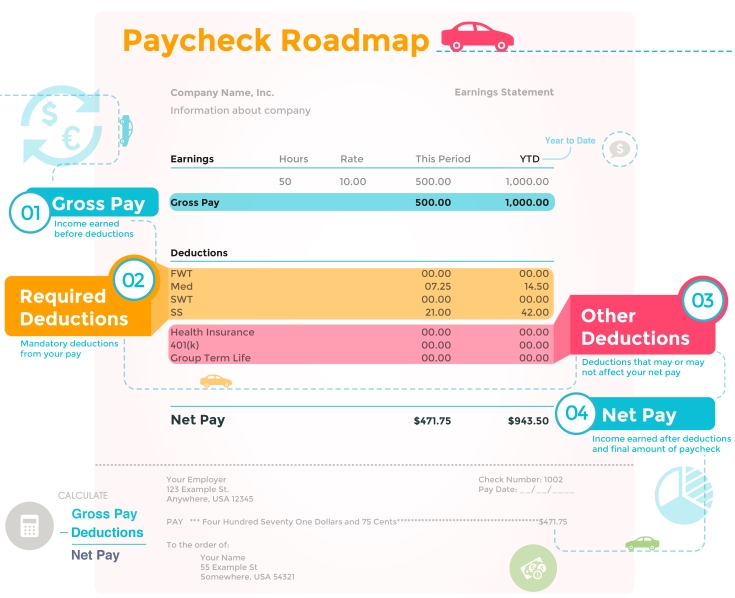

Web Gross pay is the total amount of pay before any deductions or withholding. Web Federal income tax is withheld from an employees earnings such as regular pay bonuses and commissions in addition to other types of earnings. On a pay stub this tax is abbreviated SIT which stands for.

Web Some are income tax withholding. However they dont include all taxes related to payroll. For example a single employee making 500 per weekly paycheck may have 27 in federal.

This amount is based on information provided on the employees W-4. These items go on your income tax return as payments against your. Read on for more about the federal income tax brackets for Tax Year 2019 due July 15 2020 and.

These items go on your income tax return as payments against your income tax liability. FIT Fed Income Tax SIT State Income Tax. What is the fit tax rate for 2020.

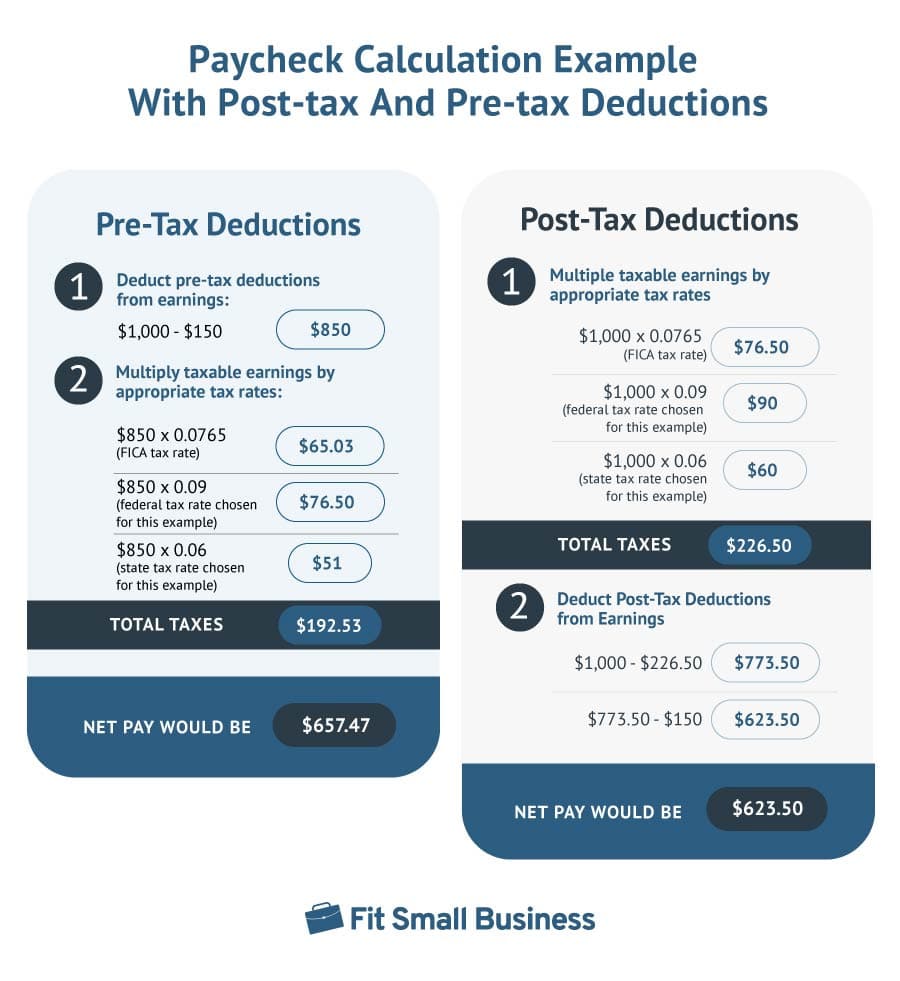

Web Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay. Web There are a few things you should know about fit deduction on your paycheck. Web Fit is the amount required by law for employers to withhold from wages to pay taxes.

Web The amount of FIT withholding will vary from employee to employee. Web FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions. On every paycheck employers have the obligation to withhold and remit to the government the federal income taxes owed by.

Web FIT is applied to taxpayers for all of their taxable income during the year. Web FIT tax refers to Federal Income Tax. The Federal Income Tax is progressive so the.

The result is that the FICA taxes. Web In other words for both 2022 2021 the FICA tax rate is 1530 split equally between the employer and employee. So Employer deducts the FICA tax of.

For employees withholding is the amount of federal income tax withheld from your paycheck. Web FIT is the amount required by law for employers to withhold from wages to pay taxes. Web The income brackets though are adjusted slightly for inflation.

Web The FIT deduction on your paycheck represents the federal tax withholding from your gross income. The amount of income tax your employer withholds.

How To Calculate Your Tax Withholding Ramsey

Take Home Pay The Deductions Taken Out Of Your Paycheck Help Support Schools Roads National Parks And More Why Do You Think You Have To Pay Taxes Ppt Download

:max_bytes(150000):strip_icc()/TermDefinition_Formw2-c8c64786d67247549052f0cb4dcd4304.png)

Form W 2 Wage And Tax Statement What It Is And How To Read It

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

How To Read A Pay Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

How To Calculate Payroll Taxes Methods Examples More

Tax Withholding Definition When And How To Adjust Irs Tax Withholding Bankrate

Paycheck Taxes Federal State Local Withholding H R Block

Calculating Federal Income Tax On Form 1040 2014 Ppt Video Online Download

Why Did My Federal Withholding Go Up

Paycheck Calculator W 4 Help Paycheck Details Form W 2

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

How To Read Employee Pay Stubs Gtm Business

Decoding Your Paystub In 2022 Entertainment Partners

The Complete Guide To Payroll Deductions

![]()

How To Calculate Payroll Taxes Step By Step Instructions Onpay